Keywords: The Financial

There are more than 200 results, only the first 200 are displayed here.

-

ECONOMICS

The question that should be posed is how effective has the Reserve Bank been at ‘managing’ the economy and financial system? ‘Not very’, has to be the answer. Not that the RBA is alone. The same pattern has been seen across the developed world. Central banks have one weapon at their disposal, the cost of money (the interest rate), and there is not much evidence they have used this tool to make their systems sustainable. Mostly, they have made matters worse.

READ MORE

-

RELIGION

- Geraldine Doogue, Greg Craven, John Warhurst, Julian Butler

- 17 June 2022

3 Comments

After four years, the Fifth Plenary Council of Australia is nearly at a close with the second and final assembly in July. So what has been the significance of the Plenary Council so far, and what can we expect from the final session? In this Roundtable, Geraldine Doogue, John Warhurst, Greg Craven and Julian Butler reveal their hopes and expectations for the process and discuss likely outcomes.

READ MORE

-

AUSTRALIA

- Andrew Hamilton

- 16 June 2022

After the Election media focus has now switched from the fresh personalities and style of the new Government to the difficulties that face it. These include the financial pressures created by heavy debt and inflation, the constraints imposed by pledges made before the election, an energy crisis, international conflicts and their effects on trade, and differences within the Party. Faced by such challenges the Government is unlikely to be able to fulfil its promises and its supporters’ hopes.

READ MORE

-

ECONOMICS

As commodity prices and inflation soar in the ‘real’ world we may be witnessing a prelude to another 2008-style crisis triggered by the foreign exchange markets. The risks certainly look similar and can be described with a simple question. Can the fictions produced by out-of-control financial actors survive reality?

READ MORE

-

ARTS AND CULTURE

- Andrew Hamilton

- 24 May 2022

1 Comment

Next week we officially enter winter. The associations of winter are largely negative. They mourn the loss of the summer that has passed. For that reason it may seem incongruous that winter should begin immediately after a Federal Election campaign that ended with the excitement of the people’s choice of a new Government. The potential for a new beginning might fit better with spring.

READ MORE

-

INTERNATIONAL

- Andrew Hamilton, David Halliday, Michele Frankeni, Stewart Braun

- 19 May 2022

5 Comments

We are now three months into the Ukraine war. From an invasion it has turned into a war of attrition that has cost many lives, displaced civilians, destroyed cities, and led to sanctions and the making of alliances with effects that have spread suffering far beyond Ukraine. In this Roundtable, Andrew Hamilton SJ, David Halliday, Michele Frankeni and Dr Stewart Braun explore the ethics of the war and likely paths to peace.

READ MORE

-

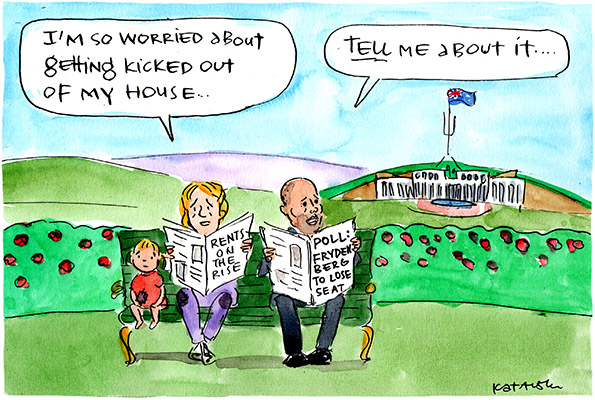

CARTOON

- Fiona Katauskas

- 17 May 2022

READ MORE

-

AUSTRALIA

- Andrew Hamilton

- 13 May 2022

2 Comments

As the election campaign mercifully comes to an end, many of us have been musing on what the new Government should do when it comes into office. It is a difficult question to answer because both Parties have excluded any radical action to address the clear and pressing needs of Australians. Fires, floods and insurance costs highlight the need for immediate and shared action to address climate change. The simultaneous high cost of housing, the inadequate benefits available to the disadvantaged, and lack of accommodation for people in need testify to the need to address the growing inequality in Australian society.

READ MORE

-

ECONOMICS

In purely economic terms, the upcoming Federal election is extremely unusual. The shut down of the Australian economy for almost two years because of health measures really has no precedent in our history. Only war can produce that type of shock. The Federal government’s financial response was as extreme as the state of emergency measures, including a sharp increase in Australian government debt. It remains to be seen, however, if the government gets much credit for injecting so much free money into the economy. It is unlikely.

READ MORE

-

CARTOON

- Fiona Katauskas

- 09 May 2022

READ MORE

-

AUSTRALIA

- Angela Costi

- 26 April 2022

1 Comment

We are told by the government and associated authorities that these are times of ‘personal responsibility’. This is undoubtedly a major transition from the heavy regulated existence not that long ago when the collective good outweighed individualism. Juxtaposed with this ‘forging forth’ expectation is the significant, if not alarming, increase in infection rates.

READ MORE

-

CARTOON

- Fiona Katauskas

- 26 April 2022

READ MORE